As you all may know, I am currently working for Comey & Shepherd Realtors. Therefore, I have a real estate license for the state of Ohio, but I will only work Cincinnati because I know this area. However, my company is part of an amazing relocation network. This network is aptly named "Leading Real Estate Companies of the World" (Leading RE in the graph below).

So basically, if you or someone you know is either:

A. Coming to Cincinnati

B. Leaving Cincinnati

C. Neither but needs help relocating from (insert any city) to (insert any city)

I can help them, free of charge and no obligations. I would receive a tip fee from the actual agent who we set them up with, but that comes out of the agent's pocket (for giving them the lead) and not the client's. Here is a chart to show what my company has done in the past year.

Let me know if you have any questions!

Buying a house for the first time can be a daunting task, look here for tips, info, and what's happening in the market!

Search This Blog

Interested In Looking For a Home?

Have questions? Thinking about looking?

Thursday, December 2, 2010

Tuesday, November 23, 2010

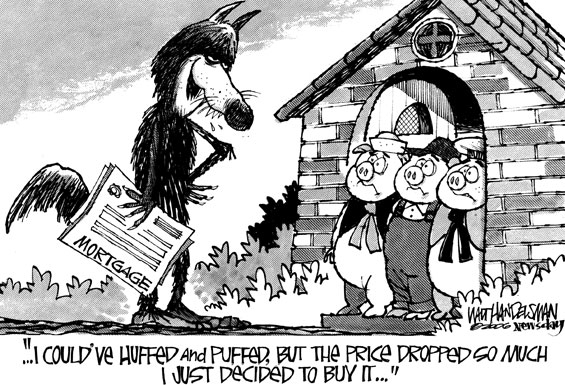

On the Fence?

Hey everyone,

Ran across this little picture thing, thought it would be nice to share. Don't bet on rates staying this low forever, nor housing prices to continue to drop! Truth is..even a 10 percent drop in prices is nullified by a 1 percent increase in your rate.

Ran across this little picture thing, thought it would be nice to share. Don't bet on rates staying this low forever, nor housing prices to continue to drop! Truth is..even a 10 percent drop in prices is nullified by a 1 percent increase in your rate.

Pretty eye opening.

Happy Thanksgiving!

Wednesday, November 17, 2010

8 Quick Tips for 1st Time Buyers

Actual Article Link

Sorry for lack of updates, been pretty busy, which is always good news. Here is a quick rundown of the article.

Have a great week and Thanksgiving if I do update til after then!

Sorry for lack of updates, been pretty busy, which is always good news. Here is a quick rundown of the article.

- Savings. You may already know how much monthly payment you can support (experts recommend no more than 1/3 your monthly income)

- Downpayment options. Do you qualify for downpayment assistance programs? Will you be able to get an FHA loan and pay 3.5 percent down?

- Check Credit Report. I suggest the website www.creditkarma.com. I used it, free, and gives you a score.

- Get Preapproved. It's time to talk to a lender! Let me know if you are interested in talking to a lender, I got two really good ones. No obligation, free, all you need is the time to meet.

- Affordability. The bank may tell you that you can afford a home worth $300,000. This does not mean you want to borrow to your max.

- Housing Criteria. You have a budget, now develop a list of what you need and want. That being said, you buy a house on your why's, not your wants.

- Hire an agent. An agent can help you navigate the entire process from searching, putting in offers, to where to hire an inspector or general contractors.

- Start the search! The MLS is a wonderful place to begin your search. Let me know if you need any help whatsoever doing this!

Have a great week and Thanksgiving if I do update til after then!

Tuesday, November 2, 2010

How Much House Can You Afford?

Taken From : Bank Vs Budget

Taken From : Bank Vs BudgetWho Decides?

- Your bank or lending institution decides. They will look at your application and based on a predefined set of criteria and decide if you can afford the home.

- Credit History-The better your credit, the lower your rate.

- Down Payment-Banks want more money down than they used to so plan for a 10% down payment. Also remember that if you can put at least 20% down, you will avoid private mortgage insurance that costs of approximately $80 per month. Wouldn't you like to have an extra $960 per year?

- Debt to Income Ratio- The debt to income ratio (DTI) looks at the amount of money you owe on a monthly basis and compares it to the money you make each month. The number is shown as a percentage of your gross income.

- Your Income- If your DTI (debt to income ratio) is 25%, but you only make $10,000 per year, you aren't going to get that home.

Tuesday, October 19, 2010

Grants for Grads

Full Article Here

I just read an interesting article (see link above) from the Columbus Dispatch talking about a grant program that helps recent college grads attain grants that help them buy a home.

I just read an interesting article (see link above) from the Columbus Dispatch talking about a grant program that helps recent college grads attain grants that help them buy a home.

- The home-buying program offers a grant worth up to 2.5 percent of the purchase price and a lower interest rate on a 30-year loan. To be eligible, applicants must have earned a college degree within the past 18 months and have graduated from an Ohio high school. The college degree can be anything from an associate to a graduate degree from a school inside or outside the state.

- Participants on average received $3,076 in down-payment assistance and paid $120,205 for their homes, she said.

- The agency currently is offering a 4.25 percent interest rate, which is up to half a percentage point lower than its other first-time home-buyers programs, he said.

Thursday, October 14, 2010

Gotta Have Options

Part of the reason for making this blog was to help first-time home buyers know "you have options". There are many paths you can take before you decide to buy that first property. I am merely posting stuff up here to show you what is out there and what is going on in the market. However, I also have friends who work in various professions that directly relate to real estate. Case in point, Mark Davis. Mark recently sent me something that I could add to the blog.

|

“Luke, more often than not people want to know what their rate is going to be and how much it’s going to cost them and believe me those are important. However, when you’re dealing with the lending environment that we all face in today’s society, there’s a lot more to it! The most important step in getting financing or even re-financing is building a strong portfolio for a bank to consider. This is where I step in with all my clients, rather than work for them, I work with them to set a financial goal. There’s so much more than just your 30 year loan, why not set yourself up for retirement with a shorter term. The point is to have options!”

So there it is, straight from the man himself. I highly suggest getting in touch with Mark with any financing questions. For example " Mark what is considered a strong portfolio and how can you help me get there". Here is his info:

Mark Davis |Mortgage Banker

American Bank

National Lending Center

150 E. Campus View Blvd Suite 200

Columbus, OH 43235

Columbus, OH 43235

Toll Free: 866-209-7652 | Local: 614-441-9233

Fax: 1-800-785-1583

I'll give anyone a plug on here that asks for one. I know I have some more buddies that work in areas of business that relate to this. You tell me how it relates to a first time buyer (or young people) and I'll post it up!!

Wednesday, October 13, 2010

Foreclosures

Foreclosures have hit the housing market hard. However, foreclosures have also been part of many of the closings as of late. Therefore, if you have been paying attention to the news lately, foreclosures could come to a screeching halt. Essentially, there is a probe going on whether certain banks "robo-signed" (fraudulently) affidavits to help move the foreclosure process along. This could be a problem because some people may have been wrongly evicted from their properties.

This affects 1st time buyers because many of these foreclosed houses could be a house you may want to buy. However, if it is found these banks committed fraud, none of these houses can be bought for the time being. Generally speaking, foreclosed properties could be interesting to the 1st time buyer because of the prices, however, the actual process is complicated, which is why it would be wise to seek counsel of a licensed agent when dealing with these properties!

READ MORE:

Housing Probe

How do Foreclosures Affect Home Sales

PNC to Halt Foreclosures

This affects 1st time buyers because many of these foreclosed houses could be a house you may want to buy. However, if it is found these banks committed fraud, none of these houses can be bought for the time being. Generally speaking, foreclosed properties could be interesting to the 1st time buyer because of the prices, however, the actual process is complicated, which is why it would be wise to seek counsel of a licensed agent when dealing with these properties!

READ MORE:

Housing Probe

How do Foreclosures Affect Home Sales

PNC to Halt Foreclosures

Thursday, September 30, 2010

Important Charts to Consider

|

Interest rates are at an all-time low! Imagine buying a house in the 80's like many of our parents did, those rates are insane! I know it is hard to read, but it shows rates being as high as 17%! |

|

| I love this chart. If you look at some of those numbers, a 100,000 dollar loan's monthly payment is cheaper than my rent! This chart is a real eye-opener! |

Monday, September 27, 2010

Loans: What is important to you

Before I took my real estate classes, I was clueless about how to finance a house. You always see commercials on TV spouting off different numbers for this and that and those numbers almost always have a * attached to them. I thought I would give a quick rundown of some basic types of loans you may encounter when purchasing your first home.

Great question to start out with: What exactly is a mortgage? If you have ever played the board game Monopoly, you've seen the word mortgage. To put it simply : "You have a certain amount of money. The home costs a certain (larger) amount of money. The home mortgage loan covers the distance between the two." Types of Home Loans

Ok, so your mortgage essentially helps you pay for your home. Now most of us will encounter mainly two types of loans, fixed-rate mortgage and an adjustable rate mortgage.

Fixed Rate Pros and Cons

Great question to start out with: What exactly is a mortgage? If you have ever played the board game Monopoly, you've seen the word mortgage. To put it simply : "You have a certain amount of money. The home costs a certain (larger) amount of money. The home mortgage loan covers the distance between the two." Types of Home Loans

Ok, so your mortgage essentially helps you pay for your home. Now most of us will encounter mainly two types of loans, fixed-rate mortgage and an adjustable rate mortgage.

Fixed Rate Pros and Cons

- Interest rate stays the same over the lifetime of the loan (usually 15 or 30 years), therefore your payment will never change

- Since it is fixed, the economy cannot effect this loan, however, you will be paying a higher interest rate for that security

Adjustable Rate Mortgage (ARM) Pros and Cons

- Low fixed rate 3, 5, or 7 years (lower than a fixed rate loan)

- However, after this introductory period, you cannot predict whether your interest rate will rise or fall

If you have any further questions about loans or the process, my preferred banker can give you a free consultation. Please do not hesitate to ask me! Rates are amazing right now!

Also, my very good friend Mark Davis works for American Bank up in Columbus and he has all the info you could ever want on loans. His contact info:

Also, my very good friend Mark Davis works for American Bank up in Columbus and he has all the info you could ever want on loans. His contact info:

Mark Davis |Mortgage Banker

American Bank

National Lending Center

150 E. Campus View Blvd Suite 200

Columbus, OH 43235

Columbus, OH 43235

Toll Free: 866-209-7652 | Local: 614-441-9233

Fax: 1-800-785-1583

Thursday, September 23, 2010

Cartoon of the Week

NPR: Professor: Now Is The Time To Buy A House

http://www.npr.org/templates/story/story.php?storyId=129800154

I am a big fan of NPR (National Public Radio), and they usually have great guests on there. Host Guy Raz talks to Karl Case, a professor of economics at Wellesley College and inventor of the Case-Shiller housing price index, about whether it's a good idea to buy a house in the current real estate market.

I am a big fan of NPR (National Public Radio), and they usually have great guests on there. Host Guy Raz talks to Karl Case, a professor of economics at Wellesley College and inventor of the Case-Shiller housing price index, about whether it's a good idea to buy a house in the current real estate market.

I know you are thinking, I don't have time to read that...sooooo...here's some key excerpts for the busy folks.

RAZ: So is it a good time to buy now, in your view?

Prof. CASE: Well, it certainly is the best time we've seen in the last four, five years, and maybe in my lifetime (I bet this dude is old also). And if you look at some of the property values that are out there, one of the things that people forget is that a house is a consumer durable good. It's not just an investment.

I am a big fan of NPR (National Public Radio), and they usually have great guests on there. Host Guy Raz talks to Karl Case, a professor of economics at Wellesley College and inventor of the Case-Shiller housing price index, about whether it's a good idea to buy a house in the current real estate market.

I am a big fan of NPR (National Public Radio), and they usually have great guests on there. Host Guy Raz talks to Karl Case, a professor of economics at Wellesley College and inventor of the Case-Shiller housing price index, about whether it's a good idea to buy a house in the current real estate market.I know you are thinking, I don't have time to read that...sooooo...here's some key excerpts for the busy folks.

RAZ: So is it a good time to buy now, in your view?

Prof. CASE: Well, it certainly is the best time we've seen in the last four, five years, and maybe in my lifetime (I bet this dude is old also). And if you look at some of the property values that are out there, one of the things that people forget is that a house is a consumer durable good. It's not just an investment.

RAZ: Now for decades, Karl Case, you know, homebuyers were told to spend a bit more than they could afford. Buying a home was the safest investment you could make. Will that advice, in your view, still be valid?

Prof. CASE: Well, I don't think it was ever valid, but I don't think it will be valid in the future. You buy something you can afford and you can make the payments whether you, you know, to promise to pay. You want to look forward with a realistic outlook and take on payments that your income can handle.

My thoughts : I think it is pretty cut and dry. This is a great time to be buying a house, people are (sadly) being forced to sell in some cases cheaper than what they bought for. However, that doesn't mean you should feel bad buying it at a great price! Also, note my underlined sentence up there, before people were taking the advice to spend a little more because in the long run it would payoff, Prof. Case points out, don't bite off more than you can chew.

Subscribe to:

Posts (Atom)